All press releases

Brightcove Announces Financial Results for Third Quarter Fiscal Year 2023

BOSTON, MA (November 1, 2023) – Brightcove Inc. (Nasdaq: BCOV), the world’s most trusted streaming technology company, today announced financial results for the third quarter ended September 30, 2023.

“Our third quarter results were highlighted by double-digit adjusted EBITDA growth and margins, as well as revenue and profitability that were at or above the high end of our guidance ranges. Our continued strength in new business in both our Enterprise and Media end-markets, including important new customer wins, demonstrates the success of our strategy and the long-term opportunity we see. Our focus in the coming quarters is to build upon this success, our market-leading position in streaming, and deliver improved year-over-year revenue and profitability,” said Marc DeBevoise, Brightcove’s Chief Executive Officer.

Third Quarter 2023 Financial Highlights:

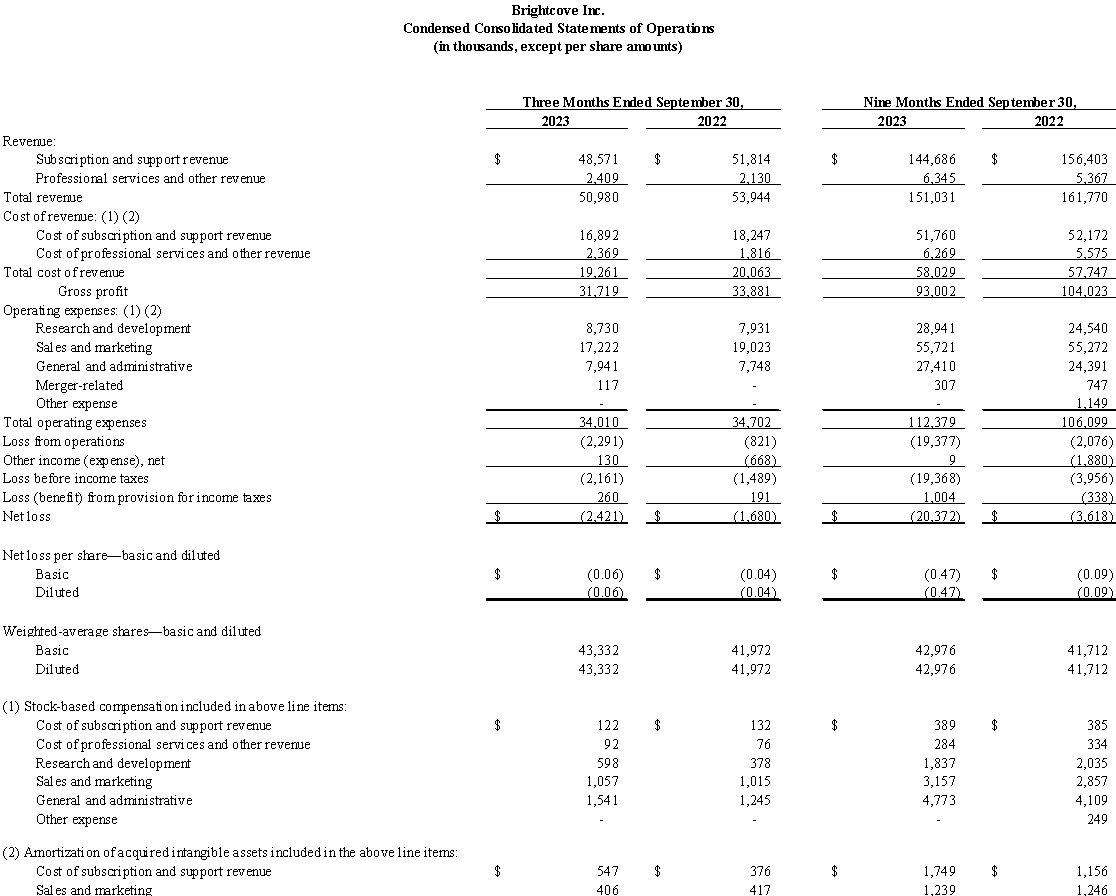

- Revenue for the third quarter of 2023 was $51.0 million, a decrease of 5% compared to $53.9 million for the third quarter of 2022. Subscription and support revenue was $48.6 million, a decrease of 6% compared to $51.8 million for the third quarter of 2022.

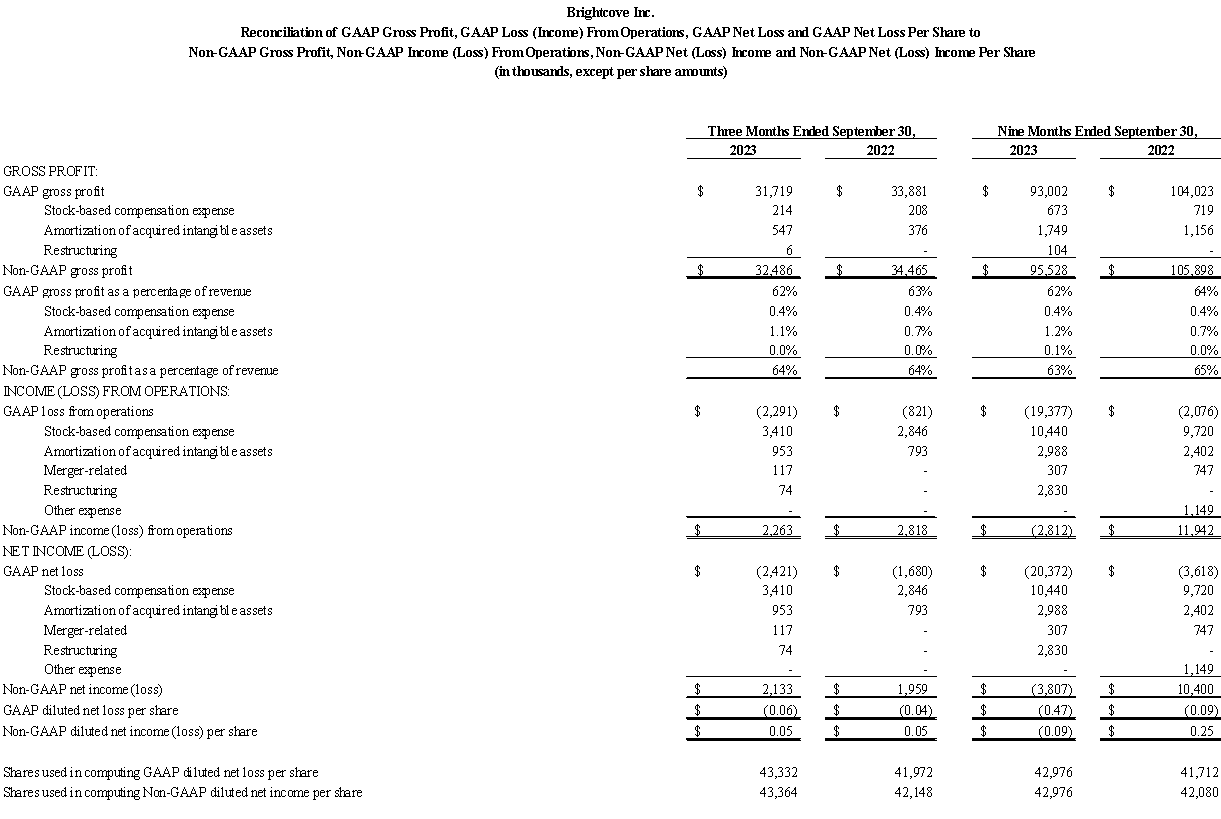

- Gross profit for the third quarter of 2023 was $31.7 million, representing a gross margin of 62%, compared to a gross profit of $33.9 million, representing a gross margin of 63% for the third quarter of 2022. Non-GAAP gross profit for the third quarter of 2023 was $32.5 million, representing a non-GAAP gross margin of 64%, compared to a non-GAAP gross profit of $34.5 million, representing a non-GAAP gross margin of 64% for the third quarter of 2022. Non-GAAP gross profit and non-GAAP gross margin exclude stock-based compensation expense, the amortization of acquired intangible assets and restructuring expenses.

- Loss from operations was $2.3 million for the third quarter of 2023, compared to loss from operations of $821,000 for the third quarter of 2022. Non-GAAP operating income, which excludes stock-based compensation expense, the amortization of acquired intangible assets, merger-related and restructuring expenses and other (benefit) expense, was $2.3 million for the third quarter of 2023, compared to non-GAAP operating income of $2.8 million during the third quarter of 2022.

- Net loss was $2.4 million, or a loss of $0.06 per diluted share, for the third quarter of 2023. This compares to a net loss of $1.7 million, or $0.04 per diluted share, for the third quarter of 2022. Non-GAAP net income, which excludes stock-based compensation expense, the amortization of acquired intangible assets, merger-related and restructuring expenses and other (benefit) expense, was $2.1 million for the third quarter of 2023, or $0.05 per diluted share, compared to non-GAAP net income of $2.0 million for the third quarter of 2022, or $0.05 per diluted share.

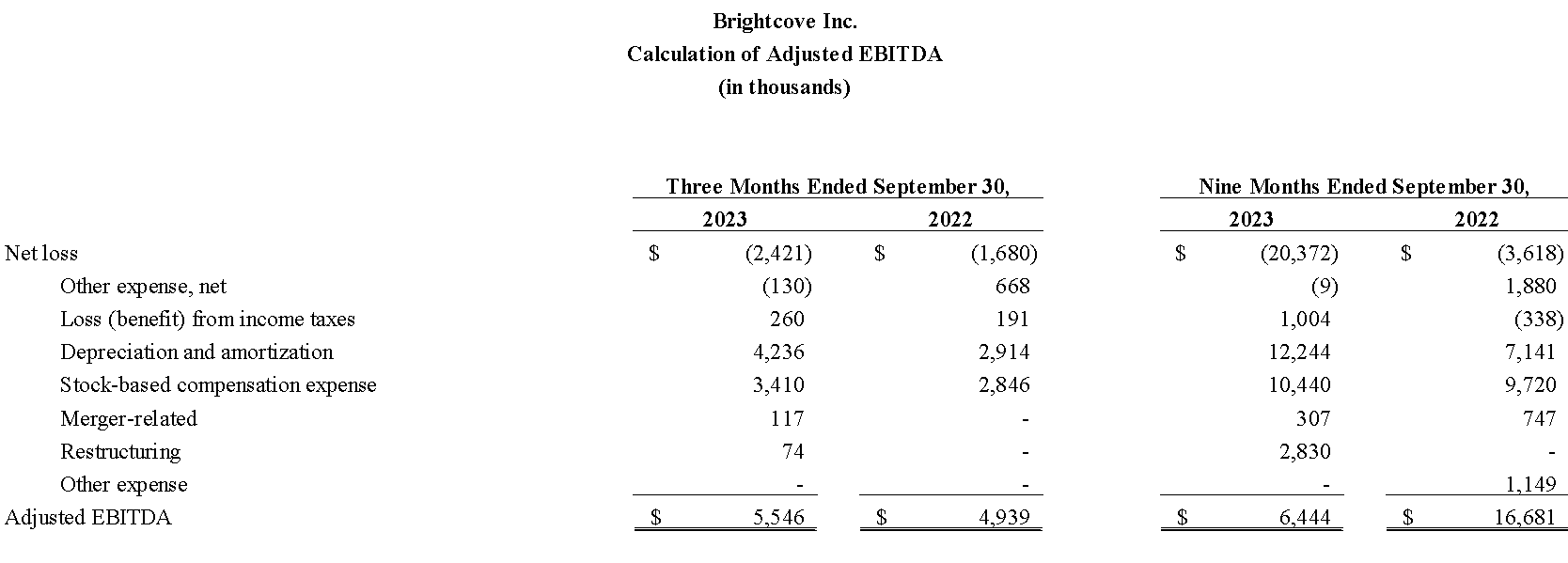

- Adjusted EBITDA was $5.5 million for the third quarter of 2023, representing an adjusted EBITDA margin of 11% and an increase of 12% compared to adjusted EBITDA of $4.9 million for the third quarter of 2022. Adjusted EBITDA excludes stock-based compensation expense, merger-related and restructuring expenses, other (benefit) expense, the amortization of acquired intangible assets, depreciation expense, other income/expense and the provision for income taxes.

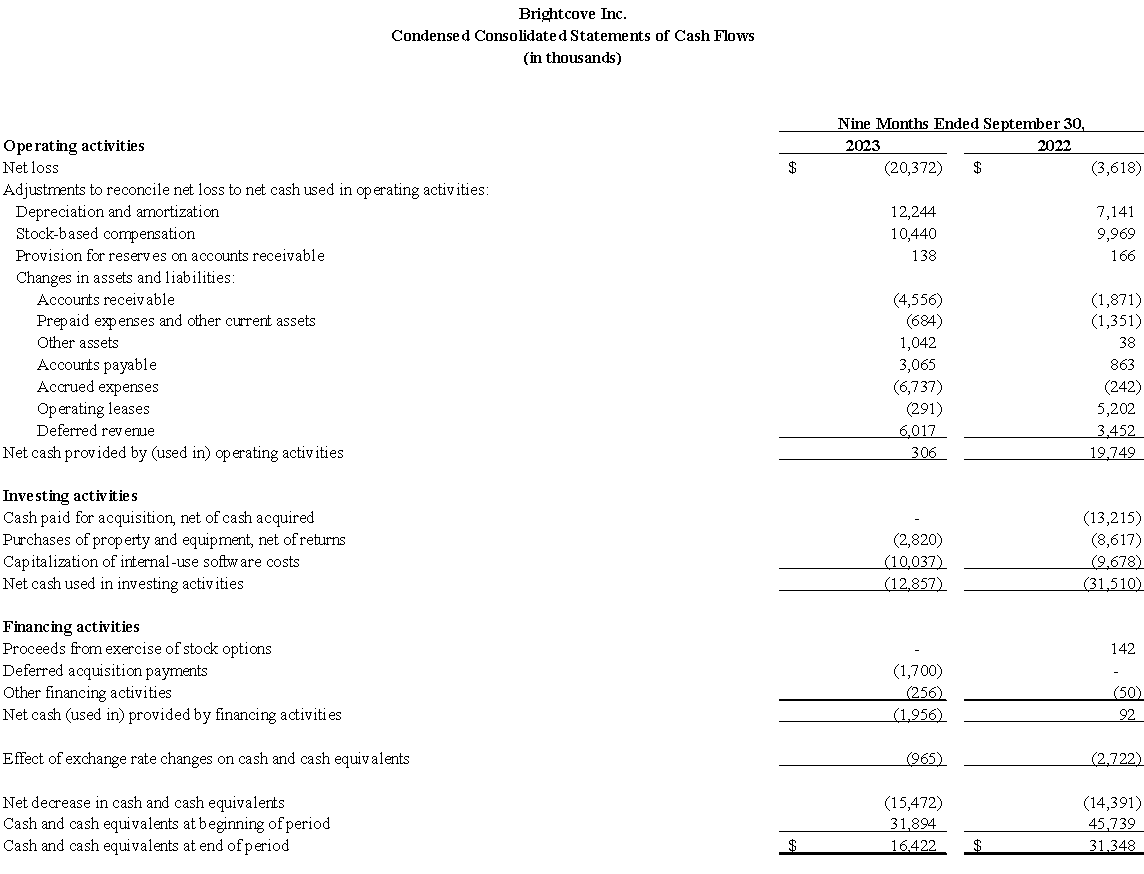

- Cash flow provided by operations was $2.1 million for the third quarter of 2023, compared to cash flow provided by operations of $10.5 million for the third quarter of 2022.

- Free cash flow was negative $2.2 million after the company invested $4.3 million in capital expenditures and capitalization of internal-use software during the third quarter of 2023. Free cash flow was positive $4.5 million for the third quarter of 2022.

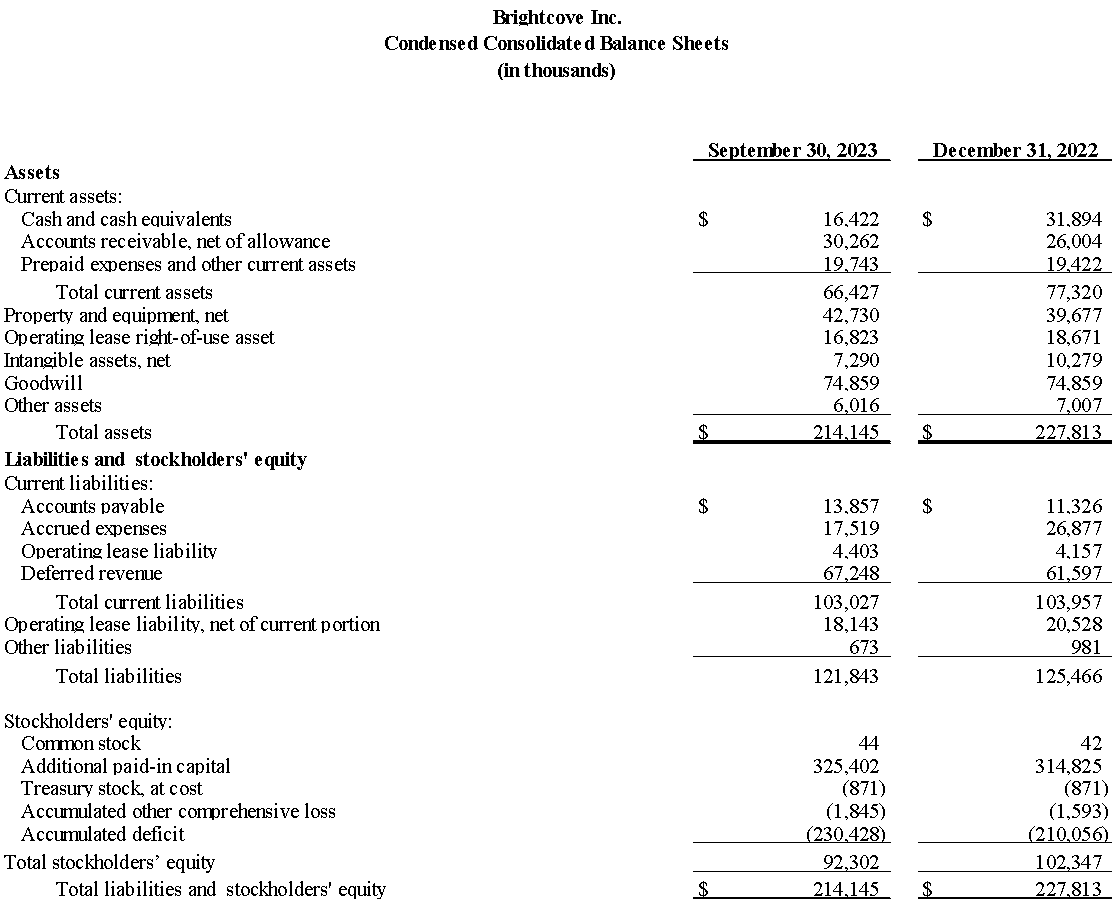

- Cash and cash equivalents were $16.4 million as of September 30, 2023 compared to $31.9 million on December 31, 2022.

A Reconciliation of GAAP to Non-GAAP results has been provided in the financial statement tables included at the end of this press release. An explanation of these measures is also included below under the heading “Non-GAAP Financial Measures.”

Other Third Quarter and Recent Highlights/Updates:

- In the Black Network (ITBN), a new OTT company focused on streaming content that showcases Black storytellers and culture, successfully launched its new streaming service powered by Brightcove’s industry-leading technology. In addition, ITBN will be using Brightcove’s Ad Monetization service to help maximize its ad revenue opportunities. Other notable media customers signed, renewed or expanded in the third quarter include Academy of Motion Picture Arts and Sciences, Carnegie Hall, CBS Television Network, Coupang, D-League, DogTV, Funny or Die, J:Com, the largest cable company in Japan, The Metropolitan Opera, RayCom Sports, and SBT, one of the largest broadcast media companies in Brazil. Additionally, we extended our leadership with media customers with the successful launches of Yahoo and the NHL on our platform, as they deliver compelling viewing experiences to their millions of customers by utilizing our end-to-end solutions.

- Announced that Acquia, the digital experience leader with Drupal at its core, has selected Brightcove to power its video marketing strategy. By leveraging the Brightcove platform, Acquia will be better able to reach current and prospective customers with market and technology trends that will increase engagement and ultimately conversion. Other notable enterprise customers signed, renewed or expanded in the third quarter include a mix of Technology, Financial Services, Consumer/Retail and other companies, including: AMC Theatres, Autodesk, Bain & Company, Blackstone, Build-a-Bear, Chick-Fil-A, CNC Technologies, Docusign, Estee Lauder, Navy Federal Credit Union, NYU Langone Health, Palo Alto Networks, ServiceNow, Tyson Foods, and VMWare.

- Named the winner of the “Best Overall Marketing Campaign Management Solution” award in the 6th annual MarTech Breakthrough Awards program, as our robust technology stack and resources demonstrated the ability to help customers enhance the viewer experience and increase audience engagement across enterprise and media customers.

- Expanded the capabilities of our platform with the successful launch of Brightcove Ad Insights, which uses machine learning models and proprietary metrics, to provide Brightcove customers with detailed analytics and insights that accurately portray viewer tolerance for ads, enabling them to optimize their ad load without disrupting the audience experience and retention. We also added PubMatic (Nasdaq: PUBM), via a previously announced partnership, as a new source of demand to our Brightcove Ad Monetization capabilities. Additionally, we extended our social distribution capabilities to include Pinterest (Nasdaq: PINS), a key social platform for our enterprise customers using video to move ecommerce.

- 12-month Backlog (which we define as the aggregate amount of committed subscription revenue related to future performance obligations in the next 12 months) was $121.1 million. This represents a 6% increase year-over-year over $113.8 million at the end of the third quarter of 2022. Total backlog was $174.2 million, a 21% increase year-over-year over $144.1 million at the end of the third quarter 2022.

- Average annual subscription revenue per premium customer was $95,900 in the third quarter of 2023, excluding starter customers who had average annualized revenue of $3,800 per customer. The average annual subscription revenue per premium customer compares to $95,900 in the third quarter of 2022.

- Ended the third quarter of 2023 with 2,618 customers, of which 2,077 were premium.

Business Outlook:

Based on information as of today, November 1, 2023, the Company is issuing the following business updates and financial guidance

Fourth Quarter 2023 Guidance:

- Revenue is expected to be in the range of $49.0 million to $51.0 million, including approximately $2.6 million of professional services revenue and $0.9 million of overages.

- Non-GAAP income from operations is expected to be in the range of $0.3 million to $2.3 million, which excludes stock-based compensation of approximately $3.5 million and the amortization of acquired intangible assets of approximately $1.0 million.

- Adjusted EBITDA is expected to be in the range of $4.0 million to $6.0 million, which excludes stock-based compensation of approximately $3.5 million, the amortization of acquired intangible assets of approximately $1.0 million, depreciation expense of approximately $3.7 million, and other (income) expense and the provision for income taxes of approximately $0.3 million.

- Non-GAAP net income per diluted share is expected to be $0.00 to $0.05, which excludes stock-based compensation of approximately $3.5 million, the amortization of acquired intangible assets of approximately $1.0 million, and assumes approximately 43.7 million weighted-average shares outstanding.

Full Year 2023 Guidance:

- Revenue is expected to be in the range of $200.0 million to $202.0 million, including approximately $8.9 million of professional services revenue and $4.8 million of overages.

- Non-GAAP loss from operations is expected to be in the range of ($2.5) million to ($0.5) million, which excludes stock-based compensation of approximately $13.9 million, the amortization of acquired intangible assets of approximately $4.0 million, merger-related expense of approximately $0.3 million, and restructuring expense of $2.8 million.

- Adjusted EBITDA is expected to be in the range of $10.4 million to $12.4 million, which excludes stock-based compensation of approximately $13.9 million, the amortization of acquired intangible assets of approximately $4.0 million, merger-related expense of approximately $0.3 million, restructuring expense of $2.8 million, depreciation expense of approximately $12.9 million, and other (income) expense and the provision for income taxes of approximately $1.3 million.

- Non-GAAP loss per diluted share is expected to be ($0.09) to ($0.04), which excludes stock-based compensation of approximately $13.9 million, the amortization of acquired intangible assets of approximately $4.0 million, merger-related expense of approximately $0.3 million, restructuring expense of $2.8 million, and assumes approximately 43.0 million weighted-average shares outstanding.

Earnings Stream Information:

Brightcove earnings will be streamed on November 1, 2023, at 5:00 p.m. (Eastern Time) to discuss the Company's financial results and current business outlook. To access the live stream, visit the “Investors” page of the Company’s website, http://investor.brightcove.com. Once the live stream concludes, an on-demand recording will be available on Brightcove’s Investor page for a limited time at http://investor.brightcove.com.

About Brightcove Inc. (NASDAQ: BCOV)

Brightcove creates the world’s most reliable, scalable, and secure streaming technology solutions to build a greater connection between companies and their audiences, no matter where they are or on which devices they consume content. In more than 60 countries, Brightcove’s intelligent video platform enables businesses to sell to customers more effectively, media leaders to stream and monetize content more reliably, and every organization to communicate with team members more powerfully. With two Technology and Engineering Emmy® Awards for innovation, uptime that consistently leads the industry, and unmatched scalability, we continuously push the boundaries of what video can do. Follow on LinkedIn, Twitter, Facebook, Instagram and YouTube. Visit www.brightcove.com.

Forward-Looking Statements

This press release includes certain “forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, including statements concerning our financial guidance for the fourth fiscal quarter and full year 2023, our position to execute on our growth strategy, the effects of our restructuring efforts, and our ability to expand our leadership position and market opportunity. These forward-looking statements include, but are not limited to, plans, objectives, expectations and intentions and other statements contained in this press release that are not historical facts and statements identified by words such as "expects," "anticipates," "intends," "plans," "believes," "seeks," "estimates" or words of similar meaning. These forward-looking statements reflect our current views about our plans, intentions, expectations, strategies and prospects, which are based on the information currently available to us and on assumptions we have made. Although we believe that our plans, intentions, expectations, strategies and prospects as reflected in or suggested by those forward-looking statements are reasonable, we can give no assurance that the plans, intentions, expectations or strategies will be attained or achieved. Furthermore, actual results may differ materially from those described in the forward-looking statements and will be affected by a variety of risks and factors that are beyond our control including, without limitation: the effect of macro-economic conditions currently affecting the global economy; our ability to retain existing customers and acquire new ones; our history of losses; expectations regarding the widespread adoption of customer demand for our products; the effects of increased competition and commoditization of services we offer, including data delivery and storage; keeping up with the rapid technological change required to remain competitive in our industry; our ability to manage our growth effectively and successfully recruit additional highly-qualified personnel; our reduction in force, including risks that the related costs and charges may be greater than anticipated and that the restructuring efforts may not generate their intended benefits, may adversely affect the Company’s internal programs and the Company’s ability to recruit and train skilled and motivated personnel, and may be distracting to employees and management; the price volatility of our common stock; and other risks set forth under the caption "Risk Factors" in our most recently filed Annual Report on Form 10-K and similar disclosures in our subsequent filings with the SEC. We assume no obligation to update any forward-looking statements contained in this document as a result of new information, future events or otherwise.

Non-GAAP Financial Measures

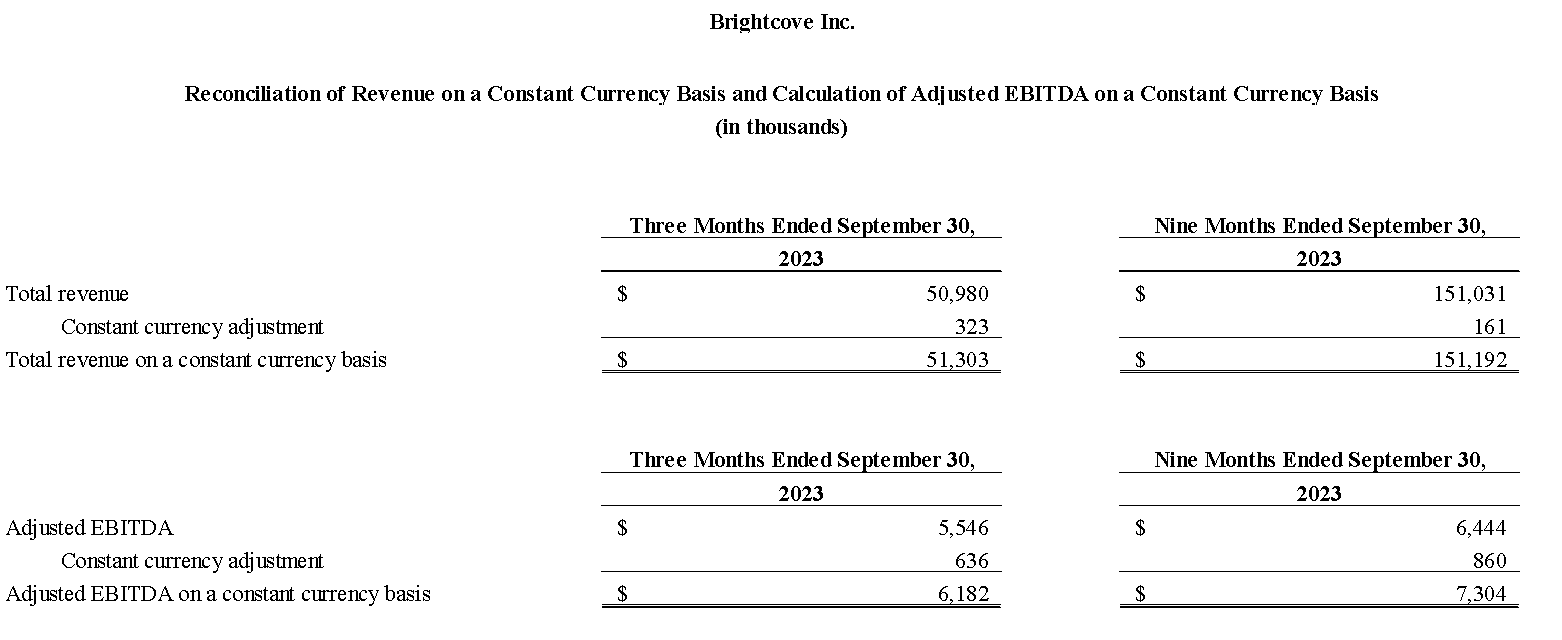

Brightcove has provided in this release the non-GAAP financial measures of non-GAAP gross profit, non-GAAP gross margin, non-GAAP income (loss) from operations, non-GAAP net income (loss), adjusted EBITDA, non-GAAP diluted net income (loss) per share, and revenue and adjusted EBITDA on a constant currency basis. Brightcove uses these non-GAAP financial measures internally in analyzing its financial results and believes they are useful to investors, as a supplement to GAAP measures, in evaluating Brightcove's ongoing operational performance. Brightcove believes that the use of these non-GAAP financial measures provides an additional tool for investors to use in evaluating ongoing operating results and trends and in comparing its financial results with other companies in Brightcove’s industry, many of which present similar non-GAAP financial measures to investors. As noted, the non-GAAP financial results discussed above of non-GAAP gross profit, non-GAAP gross margin, non-GAAP income (loss) from operations, non-GAAP net income (loss) and non-GAAP diluted net income (loss) per share exclude stock-based compensation expense, amortization of acquired intangible assets, merger-related and restructuring expenses, restructuring and other (benefit) expense. The non-GAAP financial results discussed above of adjusted EBITDA is defined as consolidated net income (loss), plus other income/expense, including interest expense and interest income, the provision for income taxes, depreciation expense, the amortization of acquired intangible assets, stock-based compensation expense, merger-related and restructuring expenses, restructuring and other (benefit) expense. Merger-related expenses include fees incurred in connection with an acquisition and restructuring expenses include primarily cash severance costs. Revenue and adjusted EBITDA on a constant currency basis reflect our revenues and adjusted EBITDA using exchange rates used for Brightcove’s Fiscal Year 2023 outlook on Brightcove’s press release on February 23, 2023. Non-GAAP financial measures have limitations as an analytical tool and should not be considered in isolation from, or as a substitute for, financial information prepared in accordance with GAAP. Investors are encouraged to review the reconciliation of these non-GAAP measures to their most directly comparable GAAP financial measures. As previously mentioned, a reconciliation of our non-GAAP financial measures to their most directly comparable GAAP measures has been provided in the financial statement tables included below in this press release. The Company’s earnings press releases containing such non-GAAP reconciliations can be found on the Investors section of the Company’s web site at http://www.brightcove.com.

Investors:

ICR for Brightcove

Brian Denyeau, 646-277-1251

brian.denyeau@icrinc.com

or

Media:

Brightcove

Sara Griggs, 929-888-4866

sgriggs@brightcove.com